Desde PragCap

I always have a good chuckle when I look at analyst’s ratings on the broad market. I got an even better chuckle when I read this story from FactSet:

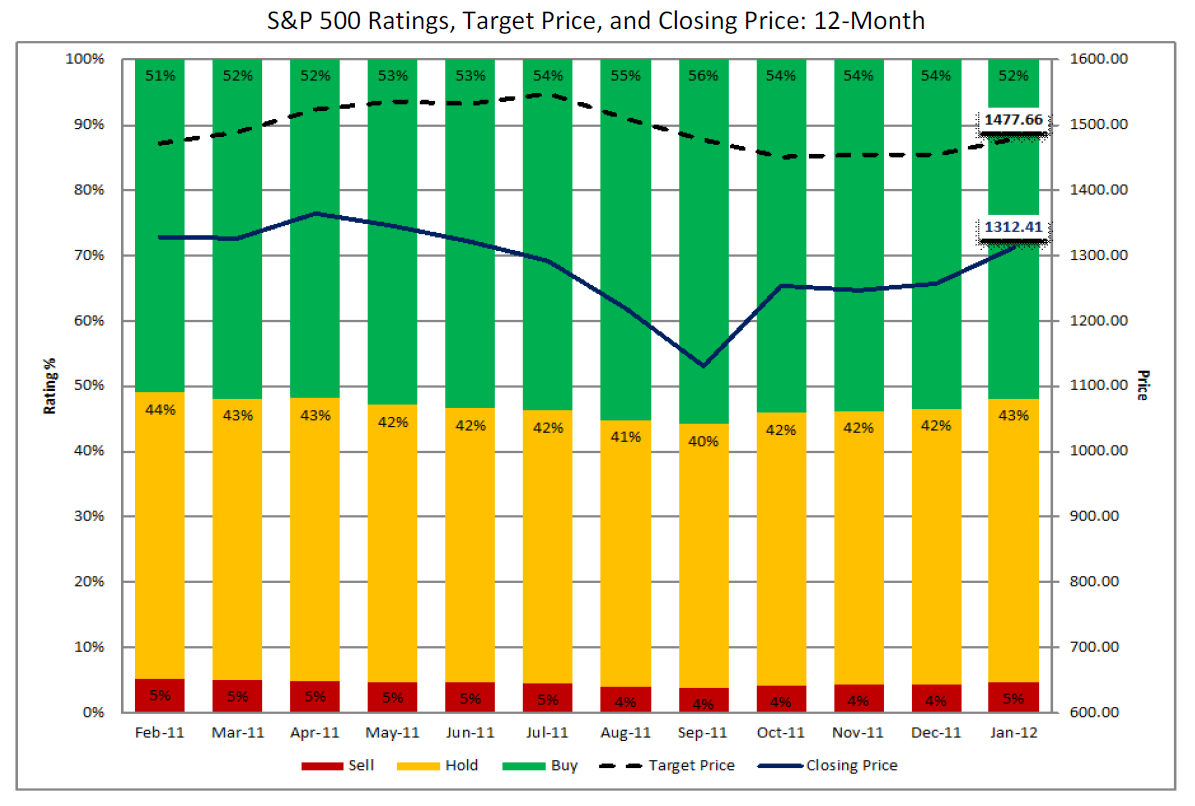

“Despite a 4.4% increase in the price of the S&P 500 over the past month, analysts have become more pessimistic on the market based on changes to their ratings since January 1. While the number of Buy ratings dipped slightly (-0.5%), the number of Hold ratings rose 6.3% and the number of Sell ratings jumped 13.2% during the month.

Overall, 52% of the ratings on companies in the S&P 500 were Buy ratings, 43% of the ratings were Hold ratings, and 5% of the ratings were Sell ratings. At the sector level, the Energy sector has the highest percentage of Buy ratings (64%), while the Utilities sector has the lowest percentage of Buy ratings (31%).”

Yes, can you feel the pessimism? That’s a whopping 1% rise in the number of sell calls. It never ceases to amaze me. I know how the Wall Street machine works and they need you in the game, but it drives me mad how analysts will always tell you when to get into a stock, but never have an exit strategy. I’ve made most of my money in stocks over the years by being a great seller. I’m a mediocre buyer. But I’m a great seller. I don’t know how any good investor can have one side of the coin without the other. And more often than not, I find that the people who are the greatest investors don’t just have an entrance strategy, but have the exit strategy mastered….

No hay comentarios:

Publicar un comentario